Hello Everyone, I am sorry that I have not posted in a while. It has been one computer issue after another. Today, I want to share some things that hackers can and will do with your site if it is not protected. Also, I want to let you know that I have been working on some new material for my site. Hope everyone that is a Mother had a wonderful Mother’s Day.

What Hackers Do With Compromised WordPress Sites

PLEASE NOTE: This entry was posted on Word Fence in Learning, Research, WordPress Security on April 19, 2016,by Dan Moen

We often talk to site owners who are surprised that their sites are targeted by attackers. Most of them assume that if there isn’t any juicy data to steal, like credit card numbers, that compromising their site is a worthless exercise. Unfortunately, they are wrong. Aside from data, a compromised site’s visitors can be monetized in various malicious ways. The web server can be used to run malicious software and host content and the reputation of the domain name and IP address can be leveraged.

Last month we ran a survey that included the following open-ended question for people who reported that their site had been compromised:

What did the hackers do to your site?

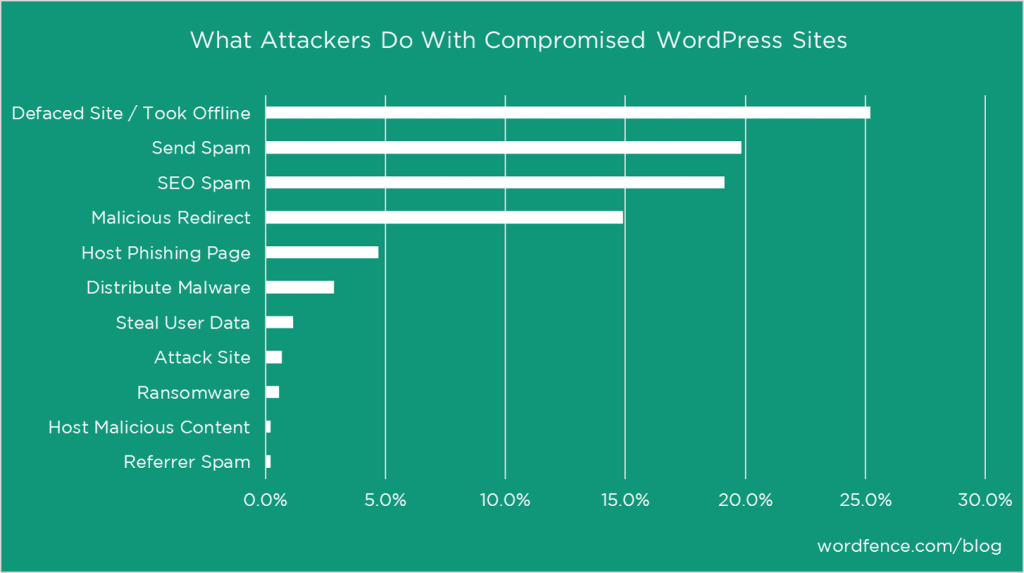

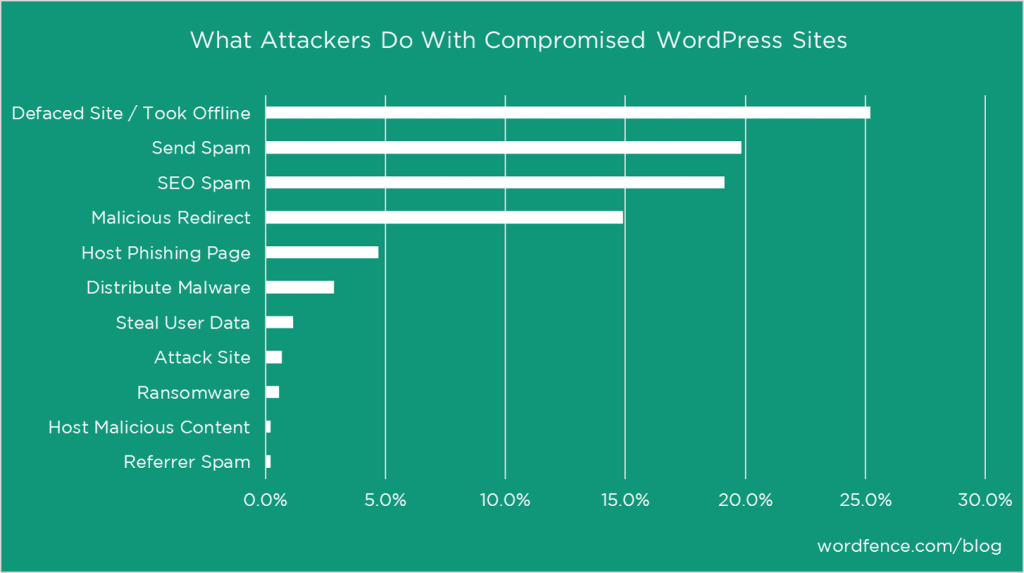

We received a total of 873 responses that could be categorized, which we did by hand. The chart below reflects the results. Many of the responses described multiple categories, so the percentages on the chart below deliberately add up to greater than 100%.

We did not include categories for “installed backdoor” or “installed malware”. We consider that to be more of a means to an end. Instead, we focused on answering the question, “what’s in it for the attacker?”.

As you can see from the chart there are a wide variety of things that attackers are doing with compromised WordPress sites. Let’s take a look at each of them, so we can better understand the motive behind the attacks that we are constantly defending against.

Defaced Site / Took Offline

In some cases, hackers replace your content with their own. The most common were political content from terrorist groups and the like. The next most common was hackers simply bragging that they hacked your site. In all of these cases, the attacker is doing absolutely nothing to obscure what they have done, anyone who visits the site immediately knows that you’ve been hacked.

In other cases the attackers just destroy your site in some way, taking it offline. Based on what we see when performing forensic research on hacked sites, in the majority of these cases, the attacker just screwed up what they were doing and accidentally took your site down.

Example of defaced website courtesy of opennet.net

What’s in it for the attacker?

For the attackers who replace your site with political propaganda, your site is just free advertising for their cause. Those that brag about taking your site down are looking for recognition.

Send Spam

Spam email continues to be a huge issue. According to Statistica, 54.4% of all email traffic on the internet was spam in December of 2015. According to our survey respondents, 19.8% of compromised WordPress sites are used to send email spam.

In many cases, the site owner was not aware that it was happening for quite some time. In some cases, they notice a slow down in site performance or a spike in server utilization that tips them off. Or their host recognizes it and alerts them.

Unfortunately, a very high percentage don’t find out until their domain has been blacklisted by spam watchdog services like Spamhaus. If you depend on email for communication with your customers or others it can have devastating consequences.

What’s in it for the attacker?

The attacker gets two huge benefits. First, they get to use the server resources that you’re paying for free of charge. Second, until they ruin your reputation, their email delivery benefits tremendously from originating from your domain and IP address. Ultimately they are trying to get people to click through to their malicious websites.

SEO Spam

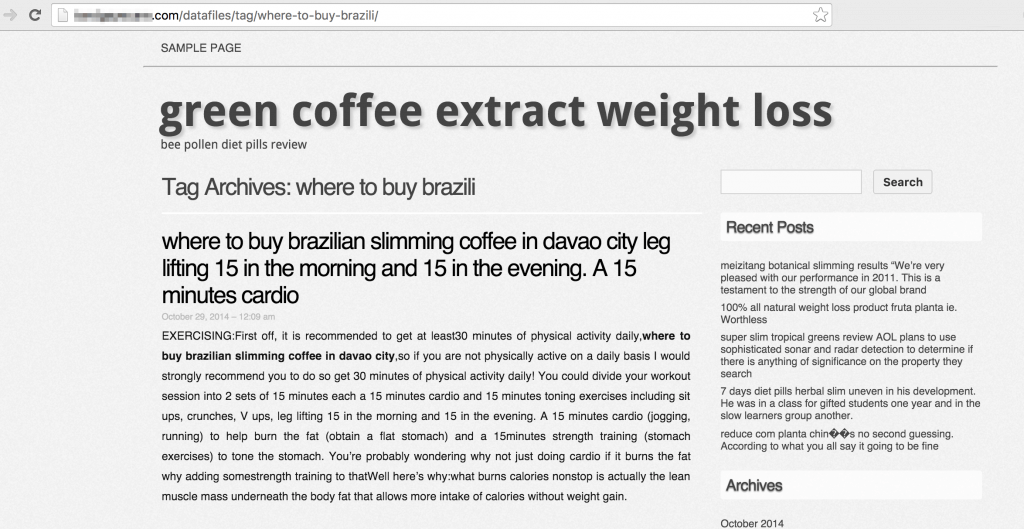

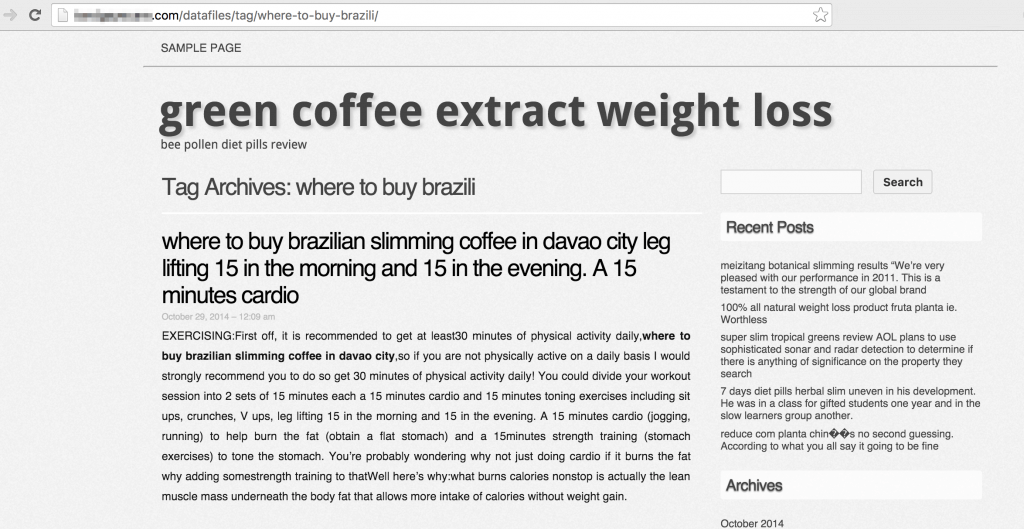

There are a number of ways attackers can leverage your website to improve their search engine rankings. The first is to simply host pages on your domain, accruing the benefits of your Domain Authority and clean reputation. Example page below.

The next is to plant links throughout your site to the site(s) they want to give an SEO boost. Since backlinks are still the most important SEO ranking factor, an attacker who compromises a large number of sites can game search engine rankings in a big way.

Many of our respondents used the term “pharma hack” to describe this type of attack because it has recently been used a lot to boost the rankings of pharmaceutical sales sites.

What’s in it for the attacker?

As I’m sure most of you know, ranking well for popular search terms is a great way to drive traffic to websites. By gaming the system with SEO spam, attackers are able to divert traffic away from legitimate sites toward their own.

Malicious Redirect

Redirects are an incredibly effective way for attackers to funnel traffic to malicious websites. The unsuspecting user doesn’t have to click on a hyperlink or advertisement for it to work, they are taken there directly.

Sometimes the attacker will take a very aggressive approach, redirecting all traffic to a malicious site or sites. But in many cases, the attackers will employ measures to avoid detection, such as only redirecting some URL requests, and in some cases only activating the redirect for specific browsers or device types.

What’s in it for the attacker?

The motive here is simply to drive traffic to their malicious content.

Host Phishing Page

Phishing pages attempt to fool the visitor into providing sensitive information. In some cases, they impersonate a bank or retailer and try to get you to give them valuable information like credit card numbers directly. In others, they try to capture your username and password to various sites, including your WordPress site if you’re not careful.

Phishing page example courtesy of eff.org

What’s in it for the attacker?

The value of your credit card number is obvious. They can use other data to break into important online accounts, use it for social engineering or spear phishing attacks or to steal your identity.

Distribute Malware

Once they have compromised your site, attackers can install malware that in turn installs malware on your website visitor’s computers without their knowledge. This is an incredibly scary proposition for you as a site owner.

If Google detects that it is happening they will flag your site via their safe browsing program. This will cause your SEO traffic to drop significantly. For more details please read our recent blog post on the impact of a hacked website on SEO. Worse than that, site visitors that are infected will not be happy with you.

The impact to your reputation could be significant and long lasting. Luckily only 2.9% of respondents reported this.

What’s in it for the attacker?

Installing malware on hundreds or thousands of your site visitor’s computers gives the attacker direct access to steal information or wreak havoc on them.

Steal User Data

Given that most people we talk to assume that attackers are interested in stealing their data, we were surprised to learn that only 1.1% of our respondents reported it happening.

We think the main reason is that the majority of WordPress sites do not store sensitive data beyond user credentials for that site and maybe email addresses. It would also be very difficult for the owner of a hacked site to detect data theft if it occurred, so the numbers are likely understated.

What’s in it for the attacker?

Stolen user credentials could be used to regain entry to the site, even if the site has been cleaned. The username / password combinations can also be attempted on other sites in hopes that the user is repeating use of passwords.

Stolen email addresses can be used for spamming. Obviously, more sensitive information like credit card numbers would be even more valuable.

Attack Site

In some cases, an attacker will decide to use your web server as a platform to launch attacks on other websites. This is relatively rare based on our respondents, who only reported this happening 0.7% of the time.

What’s in it for the attacker?

The attacker gets to use your server free of charge for their malicious activities. They also are much more likely to slip past their targets’ defenses with the attack originating from your domain and IP address. At least until they ruin your reputation.

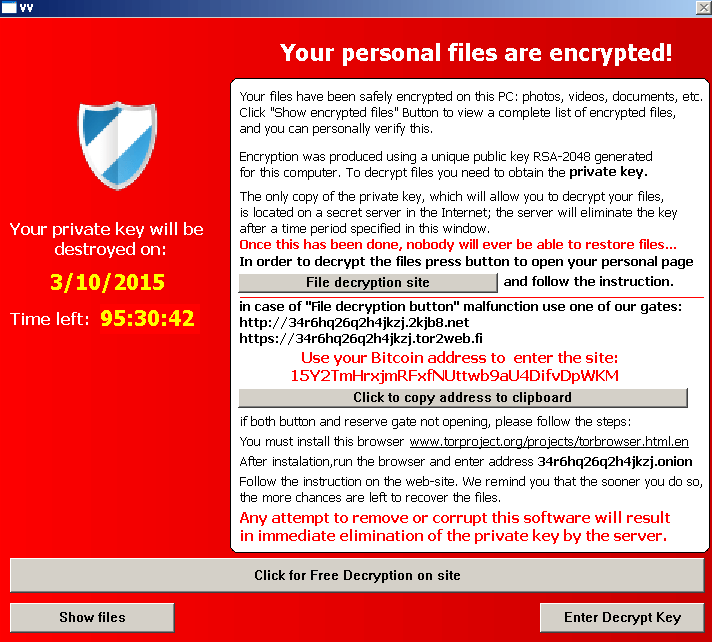

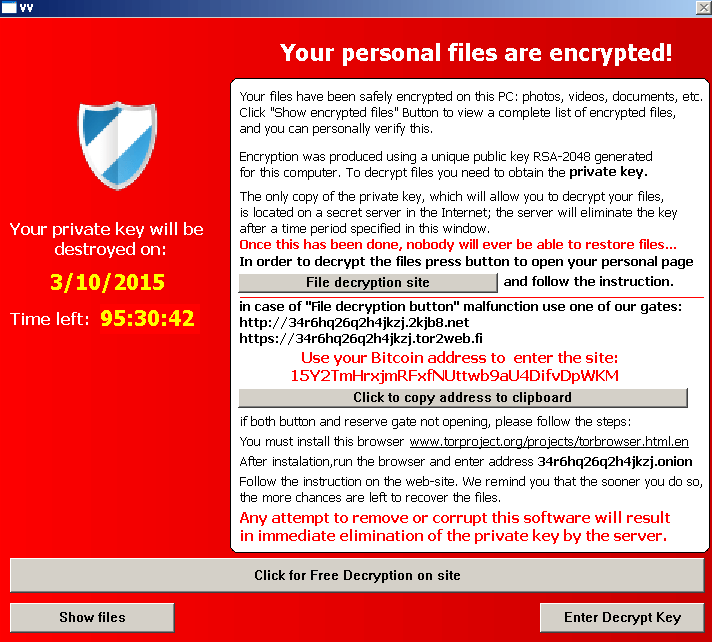

Ransomware

Ransomware is malicious software that blocks access to your website and demands that you pay a ransom in return for having access restored. This kind of attack has been receiving a lot of attention on blogs and in the press recently. So we were surprised to have only 0.6% of respondents report it.

What’s in it for the attacker?

If you don’t have backups that you were able to keep out of the hands of the attacker, you may decide that paying the ransom is worth it.

Host Malicious Content

Hackers will very often use your web server to host malicious files that they can call from other servers. They are essentially quietly using your hosting account as a file server.

What’s in it for the attacker?

The attacker gets to store their files free of charge on a server with a domain and IP address that have a squeaky clean reputation.

Referrer Spam

If you use Google Analytics you are likely familiar with referrer spam. Referrer spam is bot traffic to your site set up to look like it is coming from a fake referrer. The spammer is trying to get the website owner to check out where the traffic is coming from, driving traffic to the site.

Referrer spam example courtesy of phpmatters.com

What’s in it for the attacker?

As with a lot of the nefarious attacker activities we have already described, they get to use your server free of charge under the cover of your pristine IP address. Their ultimate goal is to drive traffic to one of their websites for reasons that often turn out to be malicious.

Conclusion

If you were of the opinion that your site couldn’t possibly be of interest to hackers, we hope that this post has changed your mind and given you some insight into their motives and methods.

Regardless of what you use your site for, how much traffic it gets or how inexpensive your hosting plan is, an attacker can figure out how to make use of it if they can break in. To learn about how attackers gain access to WordPress sites, check out our blog post from last month.

Did you enjoy this post? Share it!

May you be safe and blessed in your journey,

Star Harden

My name is Sandra Morno and I am a small business tax consultant. I have been in the tax industry for the last 9 years preparing personal and small business taxes and honestly I never saw myself doing this. But my friend, mentor, fraternity brother saw something in me and asked me to come work for him. I was working on MBA at the time and he thought that I would be a good asset to this accounting company. He taught me everything I know and is literally the biggest nerd I know. He started doing taxes back in college over 20 years and loved to read tax law books. Who does that? He taught me everything I knew, which is why I do what I do and I love it. I am an IRS Enrolled Agent which means I can represent people in front of the IRS with their tax issues and considered to be a tax specialist. My passion is to educate and guide entrepreneurs in the right direction in the formation of their businesses. I also help educate to understand the tax benefits they are entitled to, implications of running a business and inspire them to be more aware of what is going on in their business.

My name is Sandra Morno and I am a small business tax consultant. I have been in the tax industry for the last 9 years preparing personal and small business taxes and honestly I never saw myself doing this. But my friend, mentor, fraternity brother saw something in me and asked me to come work for him. I was working on MBA at the time and he thought that I would be a good asset to this accounting company. He taught me everything I know and is literally the biggest nerd I know. He started doing taxes back in college over 20 years and loved to read tax law books. Who does that? He taught me everything I knew, which is why I do what I do and I love it. I am an IRS Enrolled Agent which means I can represent people in front of the IRS with their tax issues and considered to be a tax specialist. My passion is to educate and guide entrepreneurs in the right direction in the formation of their businesses. I also help educate to understand the tax benefits they are entitled to, implications of running a business and inspire them to be more aware of what is going on in their business. 10 Strategies You May Want to Consider as You Prepare for Tax

10 Strategies You May Want to Consider as You Prepare for Tax 1. Max out retirement plans.

1. Max out retirement plans. 4. Give increased attention to buy-and-hold strategies.

4. Give increased attention to buy-and-hold strategies. 8. Review dividend distributions of your current portfolio.

8. Review dividend distributions of your current portfolio. Omojola began her financial advisory career with Goldman Sachs and was later recruited to Morgan Stanley following 8 years of service as an Intelligence Officer in The United States Army. As a Captain, Omojola completed two combat tours to Afghanistan in support of Operation Enduring Freedom. She graduated from Western New England University with a BA in Government followed by Masters in Public Administration from Central Michigan University. Omojola also attended The College of Financial Planning where she received her Chartered Retirement Planning CounselorSM designation. She holds a Series 7, 65 security licenses and the Life and Variable Annuity Insurance licenses.

Omojola began her financial advisory career with Goldman Sachs and was later recruited to Morgan Stanley following 8 years of service as an Intelligence Officer in The United States Army. As a Captain, Omojola completed two combat tours to Afghanistan in support of Operation Enduring Freedom. She graduated from Western New England University with a BA in Government followed by Masters in Public Administration from Central Michigan University. Omojola also attended The College of Financial Planning where she received her Chartered Retirement Planning CounselorSM designation. She holds a Series 7, 65 security licenses and the Life and Variable Annuity Insurance licenses.

Start by defining what you want to accomplish thanks to Internet marketing. If your goal is to bring more customers to your brick and mortar store, you should focus on local Internet marketing strategies. You could for instance, list your business with different directories and make good use of Google Pages to advertise your business to a local audience.

Start by defining what you want to accomplish thanks to Internet marketing. If your goal is to bring more customers to your brick and mortar store, you should focus on local Internet marketing strategies. You could for instance, list your business with different directories and make good use of Google Pages to advertise your business to a local audience. Write useful content to inform your audience about the items you are selling. You will get even more traffic if your site or blog is filled with useful information. You could, for instance, create some tutorials or share some news related to your field.

Write useful content to inform your audience about the items you are selling. You will get even more traffic if your site or blog is filled with useful information. You could, for instance, create some tutorials or share some news related to your field.

Editors Note: We are happy to have Omojola on the blog today to share with us 5 tips for women to help them plan to achieve their dreams and prepare for the unexpected.

Editors Note: We are happy to have Omojola on the blog today to share with us 5 tips for women to help them plan to achieve their dreams and prepare for the unexpected. When it comes to controlling the purse strings and managing day-to-day budgeting and spending, women do well. But they often don’t get involved in the wealth building part of the equation, leaving control of the invested family capital to their husband or partner.

When it comes to controlling the purse strings and managing day-to-day budgeting and spending, women do well. But they often don’t get involved in the wealth building part of the equation, leaving control of the invested family capital to their husband or partner. Open discussion about money makes it easier to develop a financial plan that takes into account your family values and goals and is flexible enough to provide the security you need if you have an understanding of all the different types of assets your family has. In my experience, if a woman asks about financial planning or shows an interest in the family investments, this can sometimes be threatening to her partner, making it difficult for her to learn about the status of financial affairs without coming across as confrontational.

Open discussion about money makes it easier to develop a financial plan that takes into account your family values and goals and is flexible enough to provide the security you need if you have an understanding of all the different types of assets your family has. In my experience, if a woman asks about financial planning or shows an interest in the family investments, this can sometimes be threatening to her partner, making it difficult for her to learn about the status of financial affairs without coming across as confrontational.

Omojola began her financial advisory career with Goldman Sachs and was later recruited to Morgan Stanley following 8 years of service as an Intelligence Officer in The United States Army. As a Captain, Omojola completed two combat tours to Afghanistan in support of Operation Enduring Freedom. She graduated from Western New England University with a BA in Government followed by Masters in Public Administration from Central Michigan University. Omojola also attended The College of Financial Planning where she received her Chartered Retirement Planning CounselorSM designation. She holds a Series 7, 65 security licenses and the Life and Variable Annuity Insurance licenses. Omojola utilizes her intelligence and planning skills to develop wealth management strategies that help clients and their families establish goals, strategize solutions, and envision clear and understandable financial path for their future. Omojola immigrated to the United States from Sierra Leone at the age of 8 and resided in Gaithersburg, Maryland. She believes a balanced life is the essence of happiness, As such; she is dedicated to helping her community be a better place to live and work. She is an active volunteer at shelters for battered women and trafficked teenage girls who are in hiding. In her spare time, Omojola enjoys exercising, playing field hockey and golfing.

Omojola began her financial advisory career with Goldman Sachs and was later recruited to Morgan Stanley following 8 years of service as an Intelligence Officer in The United States Army. As a Captain, Omojola completed two combat tours to Afghanistan in support of Operation Enduring Freedom. She graduated from Western New England University with a BA in Government followed by Masters in Public Administration from Central Michigan University. Omojola also attended The College of Financial Planning where she received her Chartered Retirement Planning CounselorSM designation. She holds a Series 7, 65 security licenses and the Life and Variable Annuity Insurance licenses. Omojola utilizes her intelligence and planning skills to develop wealth management strategies that help clients and their families establish goals, strategize solutions, and envision clear and understandable financial path for their future. Omojola immigrated to the United States from Sierra Leone at the age of 8 and resided in Gaithersburg, Maryland. She believes a balanced life is the essence of happiness, As such; she is dedicated to helping her community be a better place to live and work. She is an active volunteer at shelters for battered women and trafficked teenage girls who are in hiding. In her spare time, Omojola enjoys exercising, playing field hockey and golfing. areas, partner with the Lord in finances: pay your tithes on the gross, give to poor without grudging, spend on righteous things: food, shelter, make sure entertainment is not shady, no lottery, casinos, strip clubs, shopping for entertainment, showing off stash of cash.

areas, partner with the Lord in finances: pay your tithes on the gross, give to poor without grudging, spend on righteous things: food, shelter, make sure entertainment is not shady, no lottery, casinos, strip clubs, shopping for entertainment, showing off stash of cash.

There are a wide variety of retirement programs available, all of which can offer tax advantages to both employers and employees. Most retirement programs are based on one of two general types

There are a wide variety of retirement programs available, all of which can offer tax advantages to both employers and employees. Most retirement programs are based on one of two general types Omojola began her financial advisory career with Goldman Sachs in 2014 and was later recruited to Morgan Stanley following 8 years of service as an Intelligence Officer in The United States Army. As a Captain, Omojola completed two combat tours to Afghanistan in support of Operation Enduring Freedom. She graduated from Western New England University with a BA in Government followed by Masters in Public Administration from Central Michigan University. Omojola also attended The College of Financial Planning where she received her Chartered Retirement Planning CounselorSM designation. She holds a Series 7, 65 security licenses and the Life and Variable Annuity Insurance licenses. Omojola utilizes her intelligence and planning skills to develop wealth management strategies that help clients and their families establish goals, strategize solutions, and envision clear and understandable financial path for their future. Omojola immigrated to the United States from Sierra Leone at the age of 8 and resided in Gaithersburg, Maryland. She believes a balanced life is the essence of happiness, As such; she is dedicated to helping her community be a better place to live and work. She is an active volunteer at shelters for battered women and trafficked teenage girls who are in hiding. In her spare time, Omojola enjoys exercising, playing field hockey and golfing.

Omojola began her financial advisory career with Goldman Sachs in 2014 and was later recruited to Morgan Stanley following 8 years of service as an Intelligence Officer in The United States Army. As a Captain, Omojola completed two combat tours to Afghanistan in support of Operation Enduring Freedom. She graduated from Western New England University with a BA in Government followed by Masters in Public Administration from Central Michigan University. Omojola also attended The College of Financial Planning where she received her Chartered Retirement Planning CounselorSM designation. She holds a Series 7, 65 security licenses and the Life and Variable Annuity Insurance licenses. Omojola utilizes her intelligence and planning skills to develop wealth management strategies that help clients and their families establish goals, strategize solutions, and envision clear and understandable financial path for their future. Omojola immigrated to the United States from Sierra Leone at the age of 8 and resided in Gaithersburg, Maryland. She believes a balanced life is the essence of happiness, As such; she is dedicated to helping her community be a better place to live and work. She is an active volunteer at shelters for battered women and trafficked teenage girls who are in hiding. In her spare time, Omojola enjoys exercising, playing field hockey and golfing.

Denise is an entrepreneurial strategist that helps women go from struggling start-up to soul-fueled thriving mini-empires by getting clear on their purpose, getting confident about their value, and tapping into the systems and habits of successful changemakers.

Denise is an entrepreneurial strategist that helps women go from struggling start-up to soul-fueled thriving mini-empires by getting clear on their purpose, getting confident about their value, and tapping into the systems and habits of successful changemakers.